Passive Income for Stay-Home Mums / Wealth Accumulation Plan for Mommies!

A pair of twill woven shorts featuring slanted front pockets, buttoned back pockets, a zip pocket, buttoned waist, and keychain loop.

Overview

You will be suitable for this product if you just have either:

1) At least $10/- per day to spare for the next 1.5 years

Or

2) At least $6,000 of spare savings.

Invest in these companies today!

Suitable to those who

-Looking for lower risk wealth accumulation with decent return over a long run

-Not eyeing for short term gains. (Comparing with Stock market or self investing)

-Wants a structure plan to project and meet their financial goals in life (i.e retirement or legacy planning)

-Have an endowment/savings plan before but wishes to have more liquidity and flexibility in money

-Wishes to explore investment as a savings tool but do not want to be exposed to unnecessary risk.

Why is this so attractive?

Portfolio Strategy and Balancing

Now let us find out what's in FUNDSMITH EQUITY & BAILLIE GIFFORD...

Proven Track Record

What are the richest people investing in?

References:

https://www.yourmoney.com/investing/how-to-invest-like-a-sipp-millionaire/

Now you can buy into this famous millionaire fund without large amount of money and enjoy similar return like them!

Stock markets, at an index level always tend to go up over a long period of time.

One of the primary reasons for the upward trending graph of index is that :

-Any under-performing stock is automatically removed (based on market cap) from the index list, and

-Replaced with a better performing stock

5 Key Reasons to buy a Wealth Accumulation Plan

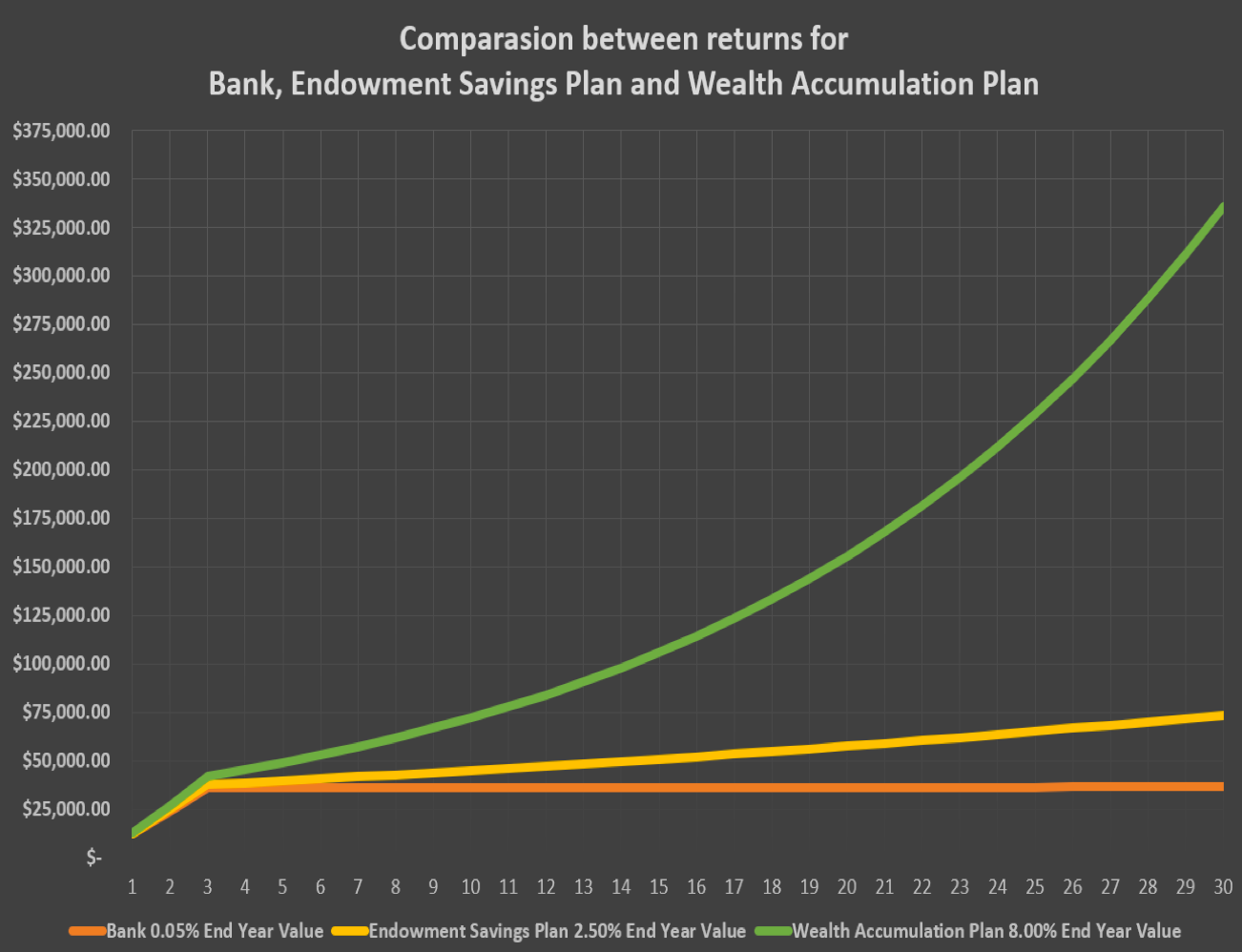

Bank V.S. Savings Plan V.S. Wealth Accumulation Plan

Why SGIM?

Let us know if you need an advisor to meet you and advise on your loved ones’ financial planning, education planning or even health and protection needs. 🤗🤗

Let us know if you need an advisor to meet you and advise on your loved ones’ financial planning, education planning or even health and protection needs. 🤗🤗